are inherited annuity distributions taxable

Get Max RMD Income Guaranteed. To help mitigate the tax consequences of inheriting a potentially large pre-tax retirement account the Internal Revenue Code permits spouses to roll an inherited retirement account over to hisher own IRA and other non-spouse beneficiaries are permitted to at least stretch distributions out over their life expectancies as well.

Offset Taxes On Inherited Iras With This Annuity Annuity Inherited Ira Ira

Inherited Roth IRAs left to non-spousal beneficiaries and Roth 401k accounts are also subject to RMDs though these distributions are not taxable.

. If youre named as beneficiary typically there wont be. A 10 IRS tax penalty may apply if you are under 59 ½ at the time of distribution. With an inherited IRA certain rules determine when you must withdraw your money.

This discussion does not apply to Roth IRAs or Roth 401k 403b and 457b accounts. You can take a lump-sum distribution from an inherited Roth IRA or an inherited Roth 401k403b457b account but since qualified distributions from these plans are tax free and nonqualified distributions are taxable only to the extent earnings are distributed the. Inheriting an IRA is not the same as inheriting a bank account or taxable investment account.

Report fully taxable distributions including early distributions on Form 1040 1040-SR or 1040-NR line 4b no entry is required on line 4a. If you took a distribution from a traditional IRA you own and had no distributions from inherited IRAs figure the taxable amount of your distribution using TaxAct through the entry of Form 1099-R and possibly Form 8606. At the time you receive the benefits youll have to pay any taxes that are payable.

In the case of the Roth 401k it can be rolled over to a Roth IRA and it will get the same treatment. 12 Things You Must Know About RMDs Retirement savers who are 72 must start withdrawing funds from tax-advantaged retirement accounts. Inherited Annuity Tax Implications.

What Are the Distribution Options for an Inherited Annuity. They do however lose the tax-free protection of the Roth. An annuity is a contract with an insurance company that promises to pay the buyer a steady stream of income in the future such as after retirement.

As with many other income taxation rules there are several exceptions to the non-natural owner rule. Bill must use the Simplified Method to figure his taxable annuity because his payments are from a qualified plan and he is under age 75. Alternatively you can wait until the year the original.

FREE Quotes on all QLAC insurance companies. Thats because you can start taking distributions from an inherited IRA early without incurring the 10 penalty. Once the annuity enters the annuitization phase they must begin paying taxes on earnings as well as any other untaxed portions.

QLAC Qualifying Longevity Annuity Contract allow to shield 145000 in IRA dollar from RMDs. Distributions from a qualified annuity are fully taxed as ordinary income. After-tax Contributions A non-qualified annuity is funded with after-tax money.

Reporting taxable distributions on your return. If only part of the distribution is taxable enter the total amount on Form 1040 1040-SR or 1040-NR line 4a and enter the taxable part on Form 1040. An annuity funded by post-tax dollars is considered a non-qualified annuity.

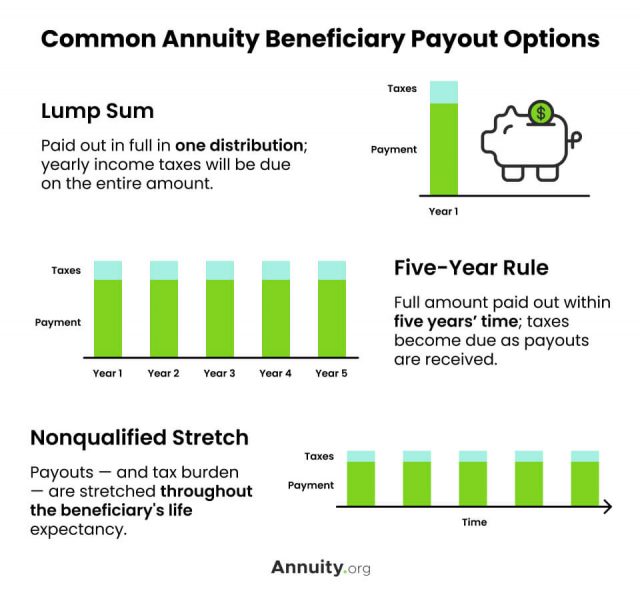

Compare Instant FREE QLAC Quotes. How inherited IRAs work. Under the five-year method you need to have taken all assets by December 31 of the fifth year after the year the original account holder.

It is possible to pay taxes on inherited annuity payments over the course of five years using the 5-year rule. Ideally when you inherit an IRA youll be the named beneficiary of the account. Inherited traditional IRA distribution with no basis and.

If Bill and Kathy. His completed worksheet is shown later. No Required Minimum Distributions.

A 1035 annuity exchange is a rule under Section 1035 of the. Shop and compare non-qualified annuities to safely grow your retirement savings or generate a guaranteed income you cant outlive. As for the RMDs for inherited IRAs there are two sets of rules.

Here is a detailed summary of the distribution options available to spouses non-spouses and trusts for inherited non-qualified annuities under IRC Section 72s. On the other hand annuity contracts owned by non-natural persons are not treated as annuity contracts for federal income tax purposes and the earnings on such contracts are taxed annually as ordinary income received or accrued by the owner during the taxable year. Only IRS approved RMD tax deferral investment until age 85.

Because his annuity is payable over the lives of more than one annuitant he uses his and Kathys combined ages and Table 2 at the bottom of Worksheet A in completing line 3 of the worksheet. On a non-qualified annuity only the gain portion is taxed as ordinary income. The Basics of Required Minimum Distributions.

Since distributions are taxed at ordinary income tax rates this change to the rule now ensures inherited IRA funds will be taxed within a decade when not inherited by a spouse. If planned well this taxable IRD gain amount can be spread over many years after the death of the annuity owner in the form of an inherited non-qualified annuity. Also crucial is whether the account is a traditional or Roth IRA as the basis may.

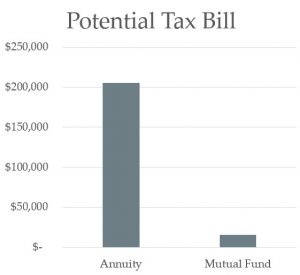

But when you take distributions from a qualified annuity the entire distribution amount contributions and earnings will be subject to ordinary income taxes. As a result annuity distributions will be taxed at the same rate as regular income. A lump-sum distribution is a one-time payout of a plan instead of having the payout broken into several.

If you inherited a pension see Survivors and Beneficiaries in IRS Publication 575 Pension and Annuity. A typical rule for annuities is last-in first-out. The inherited annuitys remaining funds can be withdrawn in a single payment if desired.

Knowing the basis of an inherited IRA can prevent the beneficiary from paying unnecessary taxes on distributions. The IRS calculates how much of an annuitized annuity withdrawal is taxable. Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account balance.

Save thousands on your IRA RMD taxes along with guaranteed lifetime income.

Understanding Annuities And Taxes Mistakes People Make Due

Tax Troubles With Annuities Ann Arbor Investment Management Vintage Financial Services

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Annuity Beneficiaries Inheriting An Annuity After Death

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

Annuity Beneficiaries Inheriting An Annuity After Death

Annuity Beneficiaries Inherited Annuities Death

Annuity Beneficiaries Inheriting An Annuity After Death

Annuities 11 Solutions To Enhance Your Retirement In 2021 Annuity Life Annuity Lifetime Income

![]()

Inherited Annuity Tax Guide For Beneficiaries

Inherited Annuity Tax Guide For Beneficiaries

Inherited Annuity Tax Guide For Beneficiaries

Taxation Of Annuities Explained Annuity 123

An Annuity Can Be Used As A Vehicle For Long Term Growth For Guaranteed Retirement Income And For Tax Benefits Annuity Financial Education Retirement Income

How To Avoid Paying Taxes On An Inherited Annuity Smartasset